private reit tax advantages

An index fund also index tracker is a mutual fund or exchange-traded fund ETF designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. The final column of the second table in the top tax bracket assumes a tax rate of 046 for the tax-efficient fund and 150 for the tax-inefficient fund.

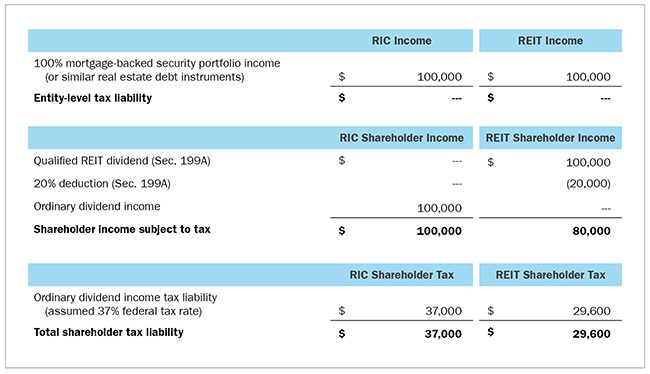

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

In 1882 Goldmans son-in-law Samuel Sachs joined the firm.

. The foreign tax credit is added to the dividend yield before computing taxes. Report state-specific corporate tax returns and IRS Form 1120 for federal tax returns. Like other private label securities backed by assets a CDO can be thought of as a promise to pay investors in a prescribed.

Investment management is the professional asset management of various securities including shareholdings bonds and other assets such as real estate to meet specified investment goals for the benefit of investorsInvestors may be institutions such as insurance companies pension funds corporations charities educational establishments or private investors either directly. They are companies that own operate and or finance real estate assets. An individual retirement arrangement or IRA is a personal savings plan that allows you to set aside money for retirement while offering you tax advantages.

These papers are also written according to your lecturers instructions and thus minimizing any chances of plagiarism. NW IR-6526 Washington DC 20224. The REIT structure was designed to provide a similar structure for investment in real estate as mutual funds provide for investment in stocks.

While index providers often emphasize that they are for-profit organizations index providers have the ability to act as reluctant regulators when determining which companies are suitable for. We have highly. In terms of law real is in relation to land property and is different from personal property while estate means.

Investing in income-producing apartments and mortgage investmentsthe most stable sector of real estate that yields consistent returns. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. Income Tax Return.

All our academic papers are written from scratch. The IRS will only issue an EIN for an IRA trust account if the individual intends to file Form 990-T Exempt Organization Business Income Tax Return or Form 1041 US. Monthly cash distributions with a Distribution ReInvestment Plan DRIP available at a 2 discount.

Their financing activities have helped provide mortgage loans for 1 million homebuyers. They are companies that own operate and or finance real. Immovable property of this nature.

A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate. Engine as all of the big players - But without the insane monthly fees and word limits. Learn about 5 types of REITs and the pros and cons to make a smart investment decision.

The rent thus collected is later. The company pioneered the use of commercial paper for entrepreneurs and joined the New. REITs have historically provided investors dividend-based income competitive market performance transparency liquidity inflation protection and.

The corporation laws of most states require that your company adopt corporate bylaws within a certain amount of time after you create your corporation. Law that allow them to pay less tax on their income than they would without them. Private equity and hedge funds enjoy several advantages under current US.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. All our clients are privileged to have all their academic papers written from scratch. Most countries laws on REITs entitle a.

REITs offer investors the benefits of real estate investment along with the ease and advantages of investing in publicly traded stock. What advantages do you get from our course help online services. Key Advantages for Investors.

A collateralized debt obligation CDO is a type of structured asset-backed security ABS. Wall St posts third straight quarterly loss as inflation weighs recession looms. Bylaws include procedural information that governs your business including.

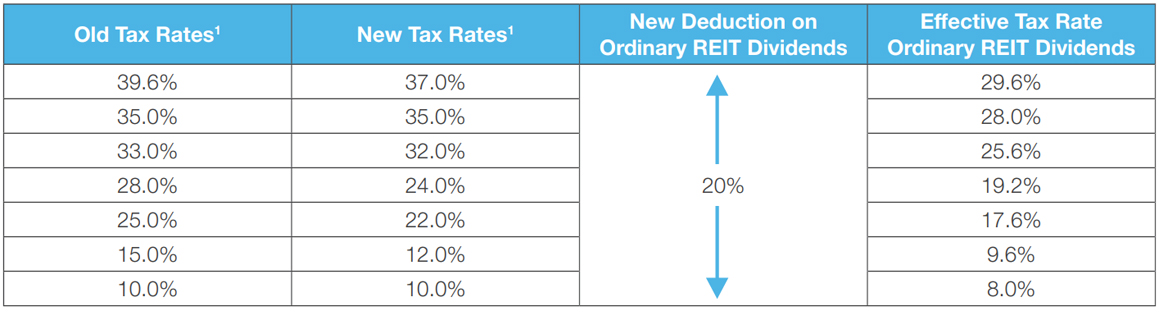

The tax advantages offered to trusts in certain jurisdictions have fueled investor interest in this type of investment vehicle. For example if a fund had 100 withheld in foreign taxes on dividends and you pay 20 in taxes on the. Originally developed as instruments for the corporate debt markets after 2002 CDOs became vehicles for refinancing mortgage-backed securities MBS.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Over 500000 Words Free. KKR Real Estate Select Trust Inc.

AI120OFF For an Instant 120 Discount. By Stephen Culp NEW YORK Reuters - The SP 500 closed the books on its steepest September decline in two decades. REITs are many things but they all start as a tax structure.

KREST is a recently organized non-diversified closed-end management investment company that intends under normal market conditions to invest at least 80 of its net assets plus the amount of its borrowings for investment purposes in a portfolio of real estate including in the form of direct. Private energy income trusts. While widely criticized these laws.

REITs or real estate investment trust can be described as a company that owns and operates real estates to generate income. Real estate investment trust companies are corporations that manage the portfolios of high-value real estate properties and mortgagesFor instance they lease properties and collect rent thereon. In 1885 Goldman took his son Henry and his son-in-law Ludwig Dreyfuss into the business and the firm adopted its present name Goldman Sachs Co.

Petrocapita Income Trust Canada. An interest vested in this also an item of real property more generally buildings or housing in general. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

Tool requires no monthly subscription. Goldman Sachs was founded in New York City in 1869 by Marcus Goldman. Important Risk Disclosures and Other Information.

Limited Special Pricing Use Coupon Code. REIT investing can be a good addition to a diversified portfolio. BREIT is a non-listed REIT that invests primarily in stabilized income-generating commercial real estate investments across asset classes in the United States and to a lesser extent real estate debt investments with a focus on current income.

By using private capital to buy residential mortgages and mortgage-backed securities RMBS mREITs help provide liquidity and credit to home mortgage markets. MREITs provide funding for mortgage credit for both homeowners and businesses. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

Summary of Risk Factors. We welcome your comments about this publication and your suggestions for future editions.

How To Invest In Real Estate Strategies To Consider White Coat Investor

Real Estate Investment Trusts Reits What Are Reits

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Sec 199a And Subchapter M Rics Vs Reits

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Advantages And Disadvantages Of Investing In Reits

Reits Vs Private Equity Real Estate What S The Difference Caliber

Real Estate Investing 101 White Coat Investor

Private Reits In A Volatile Market

What You Need To Know About Real Estate Investment Trusts Reits Vision Retirement

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

Benefits Of Establishing Private Reit Siouxfalls Business

Should You Invest In A Reit Or A Private Placement Next Level Income

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

Tax Advantages Of Reits Breit Blackstone Real Estate Income Trust

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest