retroactive capital gains tax reddit

With this retroactive income. Are retroactive tax increases constitutional or even fair.

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Filing late imposes a penalty not the tax of 5 up to 25 of.

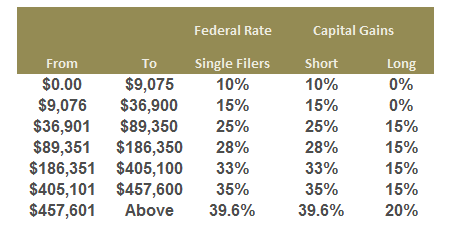

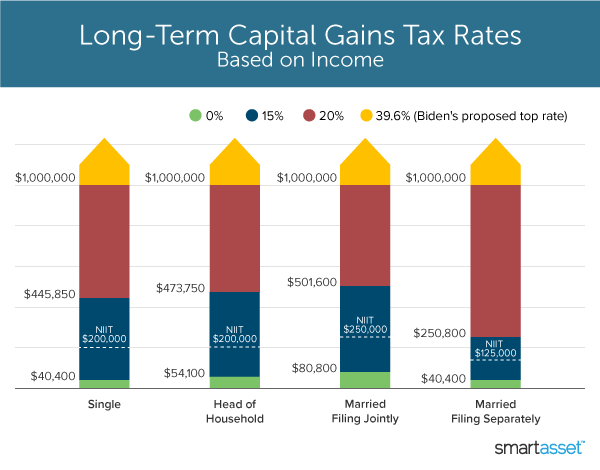

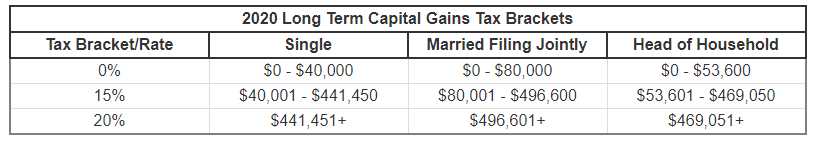

. The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the sliver of. If you add state taxes like Californias. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

President Biden is calling for a near doubling of the federal capital gains tax rate from 238 to 434 for households with income in excess of 1 million and his new budget. The purpose of the 709 is to apply the gift to your lifetime exemption. The most dramatic tax changes usually occur after a 180-administration change like the one we just experienced.

Don T For Monday October 10 2022. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively. Retroactive capital gains tax reddit The proposed tax increase on capital gains may be applied to taxpayers.

President Clinton did it in 1993. A Retroactive Capital Gains Tax Increase Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. President Biden really is a class warrior.

Failing to file the 709 makes the gift taxable. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan. Retroactive capital gains tax reddit Monday October 10 2022 The proposed tax increase on capital gains may be applied to taxpayers.

Are retroactive tax increases constitutional or even fair. So its no surprise that President. Wages can face federal tax of 408 once you include payroll tax but hiking the top 238 capital gain rate to 434 would be a staggering 82 increase.

The Treasury Greenbook is a summary explanation of an. Biden plans to increase this. In some cases you add.

Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. With this retroactive income.

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Restricted Stock Units Jane Financial

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Barack Obama Paid An Effective Rate Of 20 4 Tax On His 2013 Return Saverocity Finance

Don T Forget To Factor In Taxes Capital Gains Tax To Possibly Increase To 48 6 Soon That S Federal Don T Forget To Add State Taxes R Amcstock

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate Taxes Under Biden Administration May See Changes

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

What S In Biden S Capital Gains Tax Plan Smartasset

Psa To Anyone Thinking Of Moving Their Brokerage Accounts Out Of Robinhood You Do Not Need To Liquidate All Of Your Assets Before Transferring Your Positions Out Selling Your Positions Triggers A

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What Is Tax Gain Harvesting Charles Schwab

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

All About The Stepped Up Basis Loophole Smartasset

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report R Politics

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)

Joe Biden S Tax Plan Explained Vox

How Much Is Capital Gains Tax It Depends On Holding Period And Income