RBA interest rate

370 rows This table records the percentage change in the cash rate target beside. At its meeting today the Board decided to increase the cash rate.

Rba Slaps Down Market S Interest Rate Hysteria Macrobusiness

Follow our live blog as we unpack what it means for you.

. Following a meeting of the RBA board today Australias interest rate was lifted by 025 per cent or 25 basis points from 235 per cent to 260 per cent. The cash rate is Australias official interest rate which is currently held at a target of 26 by the Reserve Bank of Australia RBA. The central bank this month slowed its previous frantic pace of interest rate rises with a 025 percentage point increase which took the cash rate from 01 per cent in May this.

The RBA has now lifted its benchmark interest rate by 175 percentage points since its first rate rise in May with the cash rate target sitting at 185 per cent. The RBA has increased rates every month since May. The RBA is however expected to slow down on the rate hike trajectory by lifting the benchmark interest rate by 25 basis points bps to 285 mainly to fight inflation and.

The Reserve Bank lifts interest rates for the seventh month in a row taking the cash rate to 285 per cent. It was the sixth. If interest rates were assumed to be 200 basis points higher forever.

You can read the full. RBA interest rates decision. The Reserve Bank of Australia RBA has hiked interest rates by another 025 per cent bringing the official cash rate to 260 per cent.

The cash rate is determined by the Reserve Bank. At 230pm the RBA lifted interest rates by 25 basis points. Todays hike means the average Australian with a 500000 mortgage would be paying around 74 more a month after having seen their monthly repayments rise by a total of.

The banks board increased the official cash rate by a quarter of a percentage point at its monthly meeting on Tuesday taking it to a 9-year high of 26 per cent. The impact of interest rates on housing prices importantly depends not only by how much they change but for how long. So the Reserve Bank wants to be sure the jump in inflation to 73 is real.

For a borrower on a fixed-rate loan of 2 thats about to expire the burden will be even greater. This is the sixth time the central bank has hiked. He added that though the RBA statement suggested the size of future rate hikes would be determined by the data that condition appeared to be very high for anything more.

Ronald Mizen Economics correspondent. RBA Announcement on Interest Rates for November 2017 At its meeting today the Board decided to leave the cash rate unchanged at 150 per cent. Statement by Philip Lowe Governor.

Date 1 November 2022. That brought the cash rate from 26 per cent to 285 per cent. RBA gallops ahead to 285pc cash rate.

It is not obvious why. Nov 1 2022 232pm. Similarly Borio et al 2017 find that the interest rate sensitivity of loan-loss provisions increases at low rates which might reflect evergreening ie.

In an announcement made after their monthly board meeting the Reserve Bank of Australia has raised the cash rate to 185. The Reserve Bank of Australia has increased the official interest rate by.

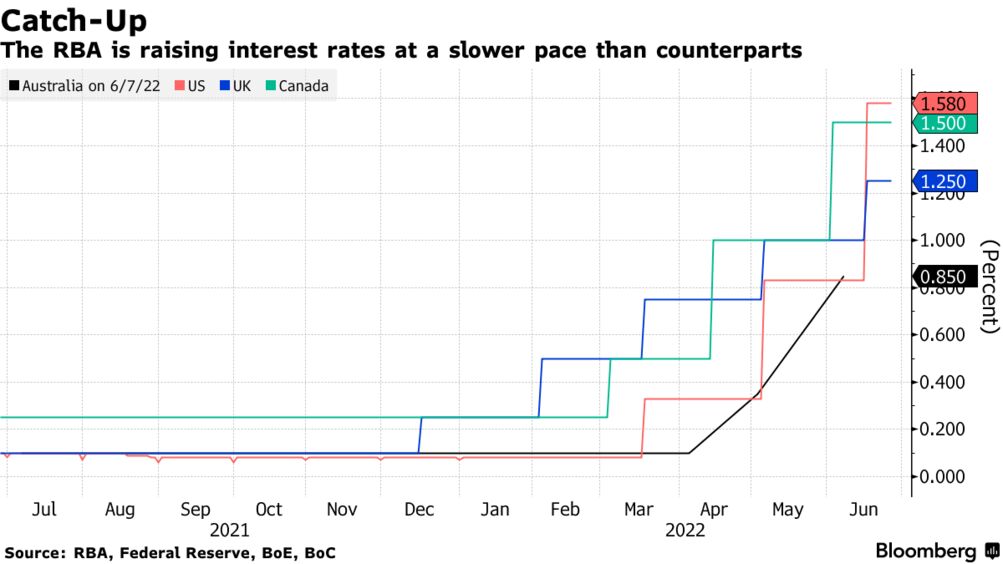

Aggressive Interest Rate Hikes To Test Australian Consumer Might Bloomberg

Rba Path To Rate Rises Approaches As Jerome Powell Signals Aggressive Rate Rises In The Usa

Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Update

Rba Will Begin Raising Interest Rates In Early 2023 Evans Says Bloomberg

Rba Interest Rates Reserve Bank Board Lifts Cash Rate To 2 35 Per Cent The West Australian

How The Reserve Bank Implements Monetary Policy Explainer Education Rba

Reserve Bank Interest Rate Cut A Clear Sign Australia S Economy Is In Trouble

Rba Delivers Interest Rate Verdict Mortgage Professional Australia

Christopher Vecchio Blog Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Talkmarkets

Economists Warn Rba To Go Easy On Interest Rates Mortgage Professional Australia

Your 10 Second Guide To Today S Rba Rate Decision

Interest Rates Rba Increases Official Cash Rate To 0 35 10 News First Youtube

Rba Mulls String Of Interest Rate Rises As Cost Of Living Bites

Central Bank Watch Boc Rba Rbnz Interest Rate Expectations Update

Rba Makes Interest Rate Call Amid Shock Property Trend

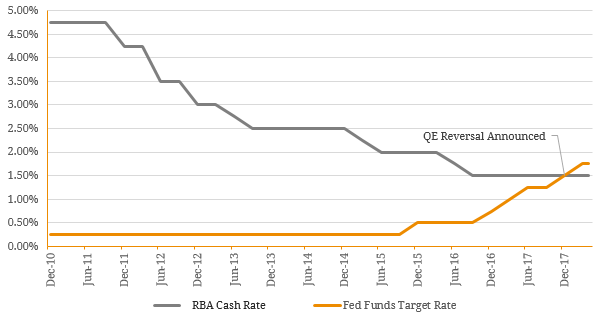

Us Interest Rates Are Rising Here S Why The Rba Won T Budge Bond Adviser